When you buy something through one of the links on our site, we may earn an affiliate commission.

What if I told you the best rental property deals never hit the market?

While most investors fight over overpriced MLS listings, the savviest buyers are locking down hidden deals through these 7 proven off-market rental property strategies. As a real estate investor who’s purchased numerous off-market units, I’m revealing the exact strategies that work in 2025 – the ones traditional agents hope you never discover.

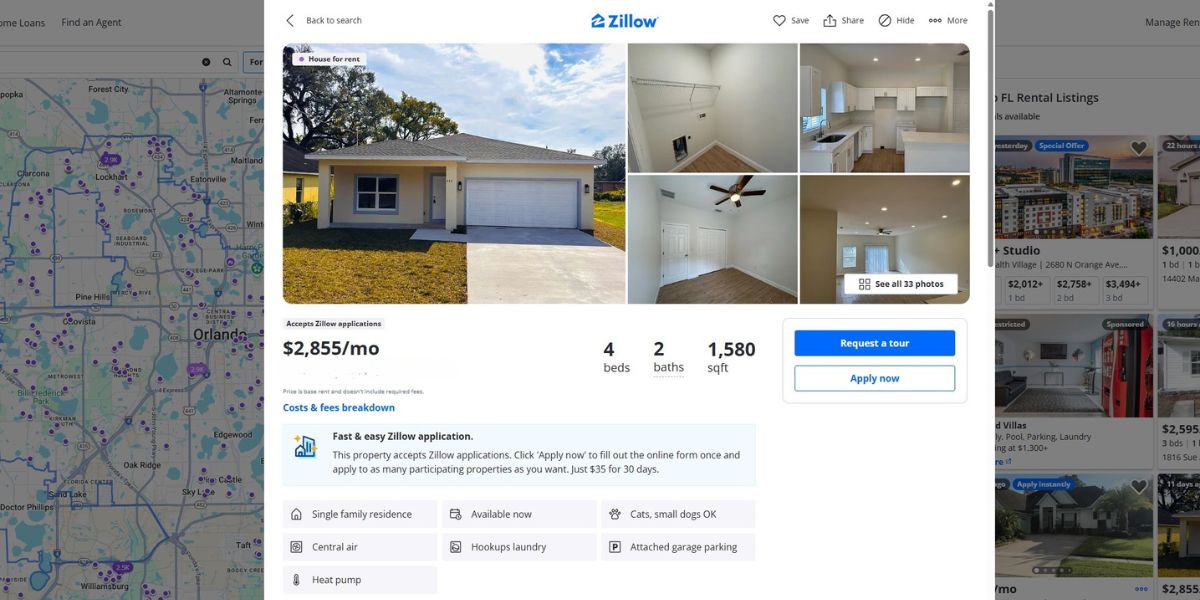

1. The “For Rent” Bait-and-Switch

How it Works

Instead of competing for listed properties, target landlords who are already advertising their rentals. Reach out as if you’re inquiring about renting—then pivot the conversation toward buying. Many frustrated landlords are open to selling but haven’t actively listed their properties.

What to Say

“Hi [Owner], I came across your rental listing and wanted to ask—have you ever considered selling? I’m an investor looking to buy in this area and can offer a quick, hassle-free purchase if you’re open to it. Either way, I appreciate your time!”

Where to Find These Deals

- Zillow Rental Manager

- Facebook Marketplace (Rental Listings)

- Craigslist Housing Section

💡Pro Tip: Focus on listings that have been active for 30+ days—these landlords may be struggling to find tenants and could be ready to sell.

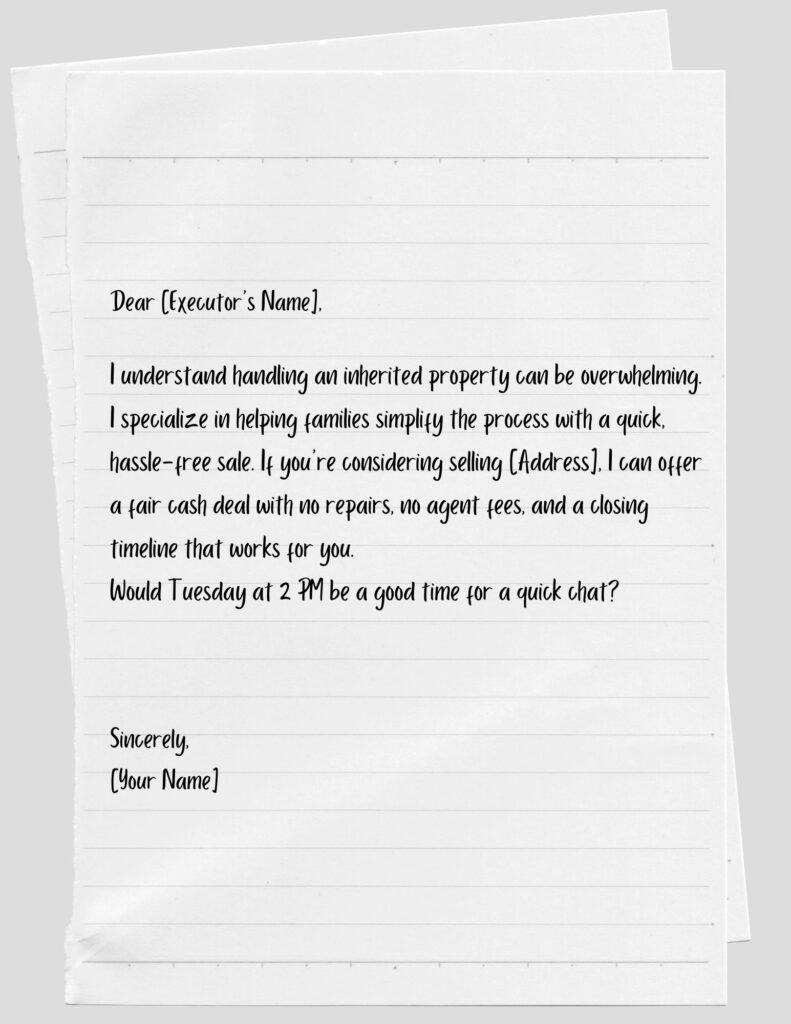

2. The Probate Property Goldmine

Why It Works

When someone inherits a property, they often want to sell quickly—especially if they live out of state, don’t want to manage tenants, or can’t afford upkeep. These motivated sellers are often willing to accept below-market offers for a fast, hassle-free sale.

How to Find Probate Deals

- Search county court records for recent probate filings. Many counties provide this information online.

- Use PropStream to identify inherited properties and their owners.

- Send handwritten letters to executors to stand out from typical investor mail.

My Proven Letter Template

💡Pro Tip: To increase your response rate, follow up with a polite phone call or second letter two weeks later. Many sellers don’t act immediately but respond after multiple touches.

3. The Tax Delinquency Tactic

Why It Works

When homeowners fall two or more years behind on property taxes, they risk foreclosure or a tax lien sale. Many are eager to offload their property before losing it entirely—making them highly motivated sellers. This is a great way of finding rental properties without a real estate agent.

How to Find These Deals

- Request the delinquent tax list from your county treasurer’s office (some counties publish these online).

- Cross-reference owner-occupied vs. absentee owners to identify the most motivated sellers.

- Prioritize properties with at least 20% equity, ensuring room for a profitable deal.

Proven Outreach Script

“Hi [Owner], I came across your property at [Address] and noticed it has some outstanding taxes. I work with homeowners in similar situations to help them avoid foreclosure with a quick, hassle-free sale. If you’re open to discussing options, I’d love to see how I can help. Would a quick call this week work for you?”

💡Pro Tip: Many tax-delinquent owners ignore letters but respond to polite door-knocking or skip-traced phone calls. If you don’t have time to knock on doors yourself, consider hiring a local door knocker (such as a gig worker or real estate assistant) to make initial contact. Paying per visit or per lead can be a cost-effective way to increase response rates.

4. The “Driving for Dollars” 2.0 Method

The 2025 Upgrade

Traditional Driving for Dollars involves scouting distressed properties in person, but with today’s tech, you can streamline the process using AI-powered tools—saving time while maximizing results.

My Proven System

- Use Google Earth & Street View to virtually spot distressed properties before hitting the road.

- Run addresses through BatchSkip to quickly find owner contact info.

- Automate follow-ups with Mailchimp to stay on top of leads effortlessly.

Signs of a Motivated Seller

- Boarded-up windows & peeling paint

- Overgrown landscaping & junk-filled yards

- Missing roof shingles or visible structural damage

- County violation notices (often a sign of neglect)

💡Pro Tip: Many investors stop at mailing postcards—go a step further by calling or texting the owner for faster responses. AI-powered dialers and SMS platforms can automate this for even higher deal conversion rates.

5. The Wholesaler Whisper Network

Inside Move

The best off-market deals often go to wholesalers first—before they ever hit investor networks. By building strong relationships with 5-7 local wholesalers, you position yourself as their go-to buyer for discounted properties.

How to Become Their Favorite Buyer

- Respond within 2 hours – Speed matters; wholesalers move fast.

- Make strong offers with minimal contingencies – Less hassle = more deals.

- Occasionally send them deals you can’t use – Reciprocity builds loyalty.

🚩Warning Signs of a Bad Wholesaler

- No repair estimates – They don’t understand the property’s true condition.

- Excessive assignment fees – Indicates they’re inflating the price.

- Pressure to waive due diligence – Huge red flag; always verify the deal.

How to Find Wholesalers

- Google these key phrases in your target market:

- “Buy my house fast in [city]”

- “Sell my house fast [city]”

- “Cash home buyers [city]”

- Call the numbers on their websites – They may not answer immediately, but leave a message introducing yourself as a serious cash buyer.

- The good ones will follow up – If they add you to their buyers list, you’ll start seeing off-market deals before the public does.

💡Pro Tip: Once you’re on a wholesaler’s list, respond to every deal—even if you’re passing. This keeps you top of mind for the next great opportunity.

6. The Facebook Ad Hack That Attracts Off-Market Sellers on Autopilot

The 2025 Twist

Instead of waiting for off-market deals, bring motivated sellers directly to you by running hyper-targeted Facebook ads. This method works especially well for absentee landlords who are tired of managing rentals from afar.

My Winning Ad Formula

- Headline: “Selling Your Rental Property? Get a Fair Cash Offer Today!”

- Image: A hand holding keys with a “SOLD” tag (clear, eye-catching, and effective).

- Targeting:

- Owners of 2-4 unit properties (small landlords are more likely to sell).

- Living 50+ miles away from the rental (higher chance of landlord fatigue).

- Aged 55-75 years old (many are nearing retirement and want to cash out).

💰Typical Cost: $3-5 per lead in most markets.

💡Pro Tip: To maximize conversions, send leads to a simple landing page with a short form and a clear call to action like: “Enter your property address for a free, no-obligation cash offer.”

This strategy automates deal flow and positions you as the solution to landlords who are already thinking about selling.

7. The “Bandit Sign” Comeback

Why It Works in 2025

In an era where digital marketing dominates, physical signs now stand out more than ever. While most investors are competing online, strategically placed bandit signs still attract motivated sellers—especially landlords looking for a fast exit.

My Highest-Converting Sign

Where to Place Them for Maximum Impact

- Near apartment complexes – Many landlords visit their properties regularly.

- At major intersections in working-class areas – These areas often have more tired landlords looking to cash out.

- Outside probate attorney offices – Families handling estates often need to sell inherited properties quickly.

💡Pro Tip: Use disposable phone numbers (Google Voice, CallRail, etc.) to track which locations perform best and avoid flagging from code enforcement.

Final Thoughts: Your Off-Market Deal Pipeline Starts Now

The best rental property deals never hit the open market—they’re secured by savvy investors who know where to look and how to take action. Real estate investing without agents can offer some of the best deals. By leveraging these seven off-market strategies, you’ll consistently find motivated sellers before your competition even knows these deals exist.

Here’s Your Game Plan

- Test multiple strategies—start with 2-3 and track what works best in your market.

- Stay persistent—off-market deals require follow-ups, but the rewards are worth it.

- Be ready to move fast—motivated sellers want solutions, not delays.

Whether you’re connecting with landlords through Facebook ads, tax delinquency lists, wholesalers, or even bandit signs, the key is taking consistent action. The investors who win in 2025 are those who build their own deal flow—not those who wait for the MLS to serve up scraps.

Which strategy will you try first? Drop a comment below and let’s talk deals!