When you buy something through one of the links on our site, we may earn an affiliate commission.

Introduction

The real estate market has undergone significant shifts since the historic lows of mortgage rates in 2020–2021. With interest rates hovering near 7%, rising property taxes, and ongoing economic uncertainty, many investors are wondering if rental properties—particularly 1–4 unit residential buildings—are still a smart choice in 2025.

The answer largely depends on your strategy, location, and financial discipline. While the days of effortless returns are behind us, well-researched investments in small multifamily properties continue to offer strong cash flow, tax advantages, and long-term wealth-building potential. This guide examines the current housing market, explores key opportunities and emerging risks, and shares actionable strategies for investing in 1–4 unit rentals today.

The State of the 2025 Housing Market

Before committing capital, it’s essential to understand the current investment landscape for multifamily real estate in 2025. Several macroeconomic and market-specific factors are shaping the real estate environment in 2025.

Interest Rates and Financing Costs

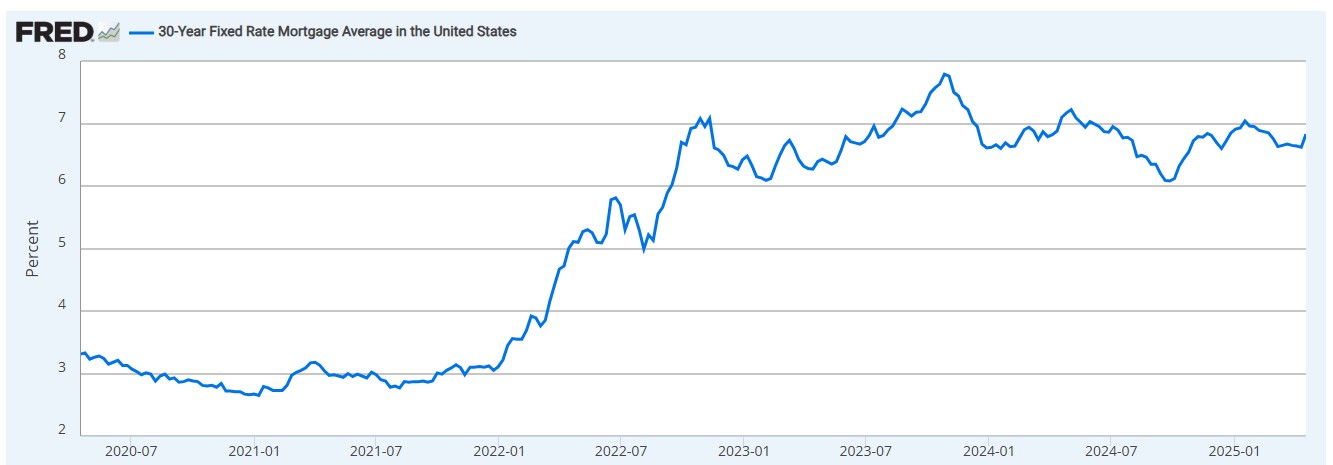

To fight inflation, the Federal Reserve has raised interest rates significantly over the past few years. As a result, 30-year fixed mortgage rates now sit in the 6–7% range—more than double the sub-3% rates seen just a few years ago. While this raise borrowing costs, it has also reduced competition from speculative buyers and amateur investors who depended on cheap debt to make deals pencil out.

Home Price Trends

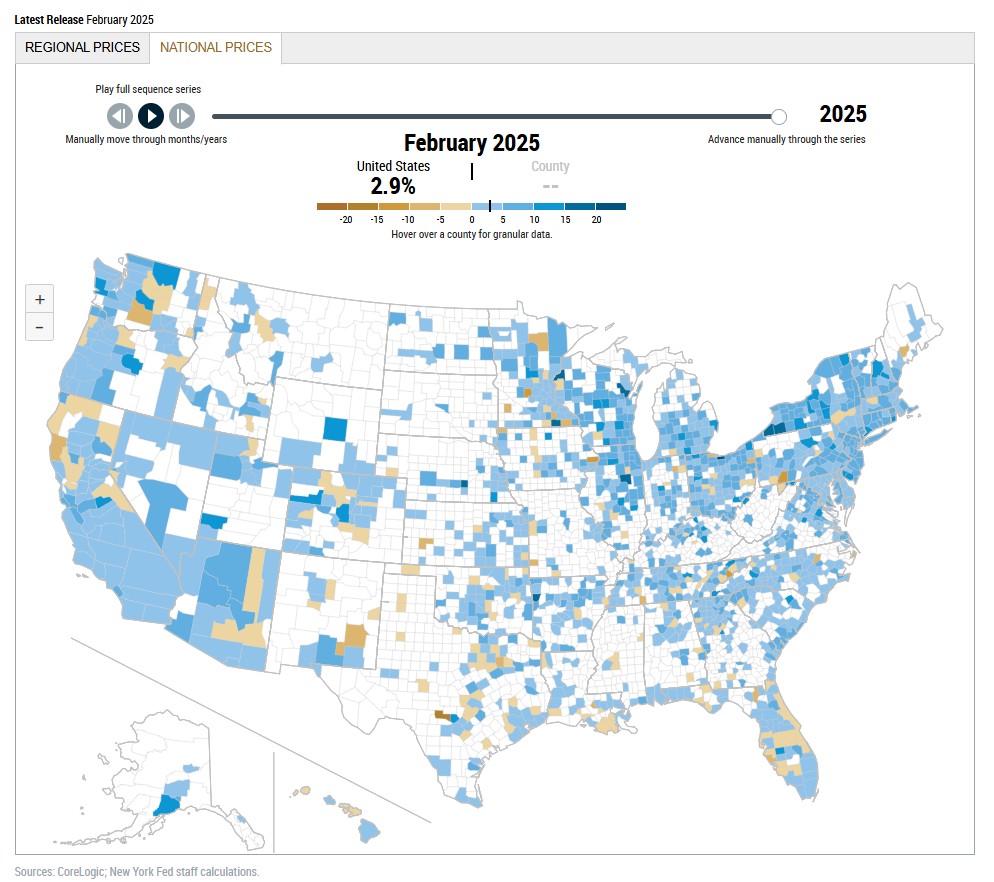

After a prolonged period of rapid appreciation, home price growth has slowed across many regions. Some of the markets that overheated during the pandemic—such as Austin and Boise—have seen mild corrections. In contrast, affordable Midwest and Southern markets remain relatively stable due to persistent housing shortages. The national median home price remains about 25% higher than pre-pandemic levels, making cash flow—not appreciation—the primary focus for smart investors.

Rental Demand Dynamics

High interest rates have priced out many would-be homebuyers, effectively expanding the pool of long-term renters. Millennials and Gen Z, often saddled with student debt and high living costs, are renting longer than previous generations. As a result, vacancy rates remain historically low—under 6% nationally—supporting steady rent growth in most regions.

Construction and Housing Supply

The U.S. continues to face a structural shortage of 3–5 million homes, a result of decades of underbuilding. Although new multifamily construction has increased in recent years, much of it targets luxury developments. Inventory for single-family homes and small multifamily properties remains constrained, particularly in high-growth areas. This imbalance continues to support both rent prices and property values.

Why 1–4 Unit Rentals Remain a Smart Investment

Why invest in small multifamily properties? Despite the headwinds of higher rates and rising costs, small multifamily properties still offer compelling advantages in today’s environment.

Recession-Resistant Cash Flow

Unlike commercial real estate or fix-and-flip strategies, residential rentals provide consistent, durable income. Housing is a non-discretionary expense, and demand for it remains steady even during economic downturns. Smaller multifamily buildings—like duplexes and triplexes—often outperform single-family homes in cash flow thanks to shared infrastructure and the ability to spread operating expenses across multiple units.

Favorable Financing Options

Financing for 1–4 unit properties remains attractive relative to larger commercial deals. Government-backed loans like FHA and Fannie Mae still offer competitive terms, particularly for owner-occupants looking to “house hack” by living in one unit and renting out the others. Even investors not living on-site can access 30-year fixed-rate loans with relatively low down payments. For those with larger portfolios, portfolio loans from community banks or credit unions can offer added flexibility.

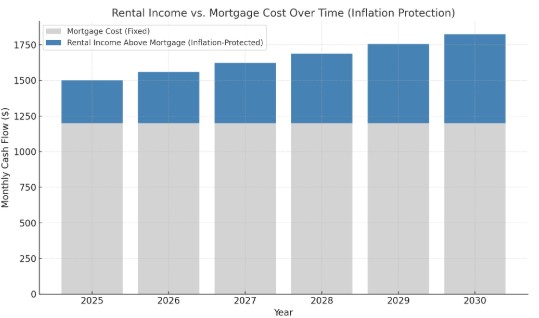

Inflation Protection

Rental income tends to rise with inflation, while fixed-rate mortgages lock in borrowing costs for the long term. For example, a 4% annual rent increase on a $1,500/month unit results in an additional $720 in profit by year three—with no change to the mortgage payment. This inflation hedging makes rentals particularly attractive during periods of monetary tightening.

Tax Efficiency

Real estate offers a wide range of tax benefits not available in other asset classes. Investors can deduct mortgage interest, property taxes, insurance, maintenance, and depreciation (typically over 27.5 years for residential property). The 1031 exchange also enables the deferral of capital gains taxes when proceeds are reinvested into another like-kind property, helping investors grow their portfolios tax-deferred.

Lower Institutional Competition

While institutional investors have poured billions into single-family rentals in recent years, they rarely target small multifamily properties. Managing duplexes and triplexes at scale is operationally complex for large firms, which gives individual investors a unique edge. Off-market deals, seller financing, and relationship-based acquisitions are still very much alive in this space.

Key Risks to Watch in 2025

Success in today’s market requires not just opportunity-seeking, but risk management. Here are the main challenges investors should prepare for.

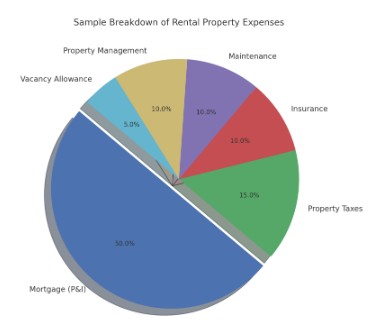

Rising Operating Expenses

Insurance premiums have surged—up 20–40% in high-risk states like Florida and California—due to increased climate-related claims. Property taxes are also trending higher, as municipalities reassess property values and budgets post-pandemic. Maintenance costs have climbed as well, with investors now wisely budgeting 8–10% of gross rent for ongoing repairs and upkeep—compared to just 5% in past years.

Regional Market Volatility

Some markets that saw explosive growth during the pandemic—such as Phoenix and Las Vegas—are showing signs of cooling as remote workers relocate and affordability worsens. Investors should prioritize metros with diversified job bases, growing populations, and housing affordability metrics that align with local wages. Cities driven by a single industry are at higher risk of economic shock.

Evolving Regulations

The legal landscape for landlords is shifting in many parts of the country. Rent control policies are spreading in cities like Minneapolis and Portland, which can cap revenue growth. Some states, like New York, have enacted “good cause” eviction laws, making tenant removal more difficult even in cases of lease violations. Investors should always understand state and local laws before purchasing.

How to Succeed in Today’s Market

Choosing the Right Market

Location remains one of the most critical variables in real estate success. Look for cities with robust job growth (2%+ annually), strong population inflows, and landlord-friendly regulations. Markets where the median home price is less than 4x the median income often offer the best balance of affordability and rent potential. Areas anchored by universities, military bases, or large healthcare systems tend to offer stable demand for rentals.

Smart Deal Analysis

In today’s market, conservative underwriting is essential. Investors should evaluate potential purchases using realistic assumptions that reflect current economic conditions. Mortgage rates remain in the 6–7% range, so it’s wise to underwrite deals at a 7% interest rate and stress-test them at 8% to ensure resilience in case rates rise further.

Projected occupancy should be set at 95%, slightly below the near-perfect rates many investors used before 2022. This adjustment provides a more accurate buffer for occasional turnover or longer leasing periods.

Operating expenses also warrant a more cautious approach. Maintenance should be budgeted at around 8% of gross rents, reflecting rising labor and materials costs. Property management expenses, even if you plan to self-manage initially, should be included in the analysis—typically in the 5–10% range. Factoring these in not only gives you a clearer picture of true returns but also prepares your portfolio for scaling or eventual outsourcing.

Rather than relying on appreciation, the focus should be on solid in-place cash flow, strong fundamentals, and room for operational improvements. Deals that may not deliver explosive short-term gains can still generate reliable income, equity growth, and long-term financial stability when analyzed and managed prudently.

Leveraging Creative Financing

In a high-rate environment, flexibility is key. Seller financing is making a comeback as older landlords look to retire and are open to favorable terms in exchange for steady income. Lease options and rent-to-own arrangements can help newer investors control properties with minimal capital. The BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) remains a powerful way to recycle capital—especially in value-add situations.

Long-Term Outlook and Final Thoughts

Are small multifamily rentals still worth it? Yes. The 2025 market is more complex than in previous years, but small multifamily properties remain one of the most reliable paths to financial independence. Investors who adapt to today’s conditions—by focusing on cash flow, budgeting conservatively, and using creative strategies—can still earn annualized returns of 10–15%.

To succeed:

- Prioritize cash flow over appreciation.

- Use house hacking to reduce your living expenses and scale more quickly.

- Build strong relationships with local agents, wholesalers, and lenders to uncover deals others miss.

- Maintain a cash reserve of at least six months of expenses to cushion against vacancies, repairs, or economic shifts.

The era of easy money may be over, but disciplined investors who buy right, manage smartly, and think long-term will continue to build wealth—one unit at a time.