When you buy something through one of the links on our site, we may earn an affiliate commission.

The Power of Predictable Financing

What if you could build wealth in real estate without fearing rising interest rates or market crashes? For buy-and-hold investors, the 30-year fixed-rate mortgage is more than just a loan—it’s a powerful financial tool.

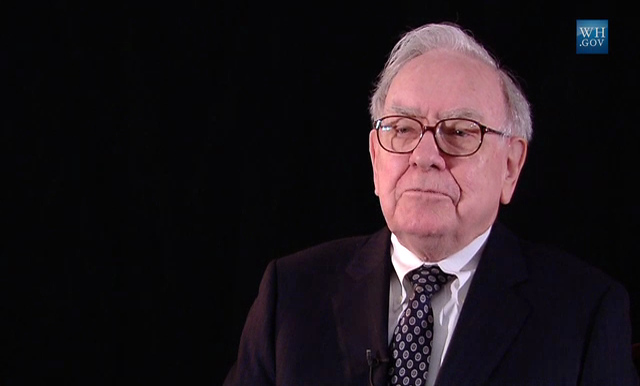

Even Warren Buffett, a man who famously avoids debt, called the 30-year mortgage “the best instrument in the world.” When asked about his own home purchase, he said:

“If I were an investor today, I would load up on 30-year mortgages.”

This post explores why that advice makes perfect sense for investors in single-family homes, duplexes, triplexes, and fourplexes.

Predictable Payments = Peace of Mind

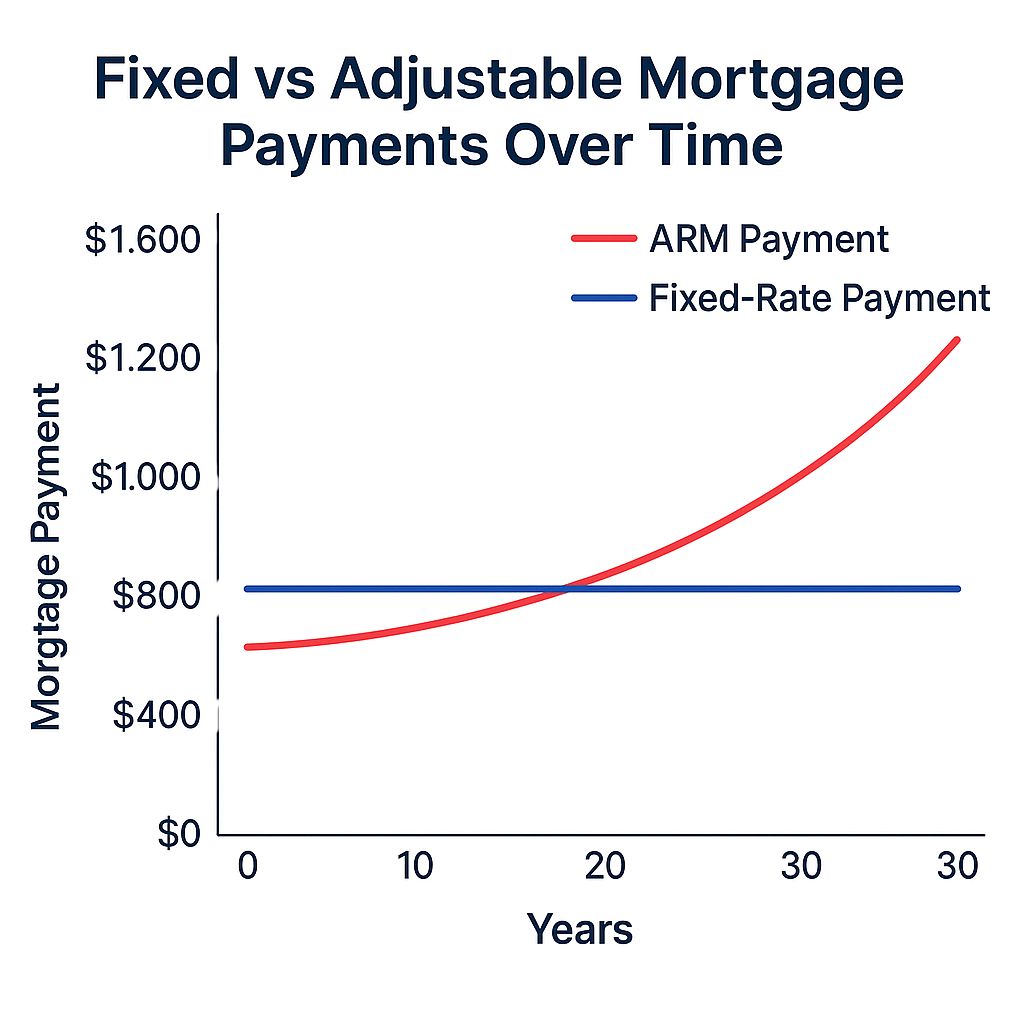

One of the greatest advantages of the 30-year fixed loan is stability. Your principal and interest never change, no matter what happens in the broader economy.

Imagine locking in a $300,000 loan at 6.5%. Your payment stays at $1,896 per month, even if rates spike to 10%.

For rental property owners, that kind of predictability makes it easy to plan, forecast cash flow, and avoid nasty surprises.

You won’t get this peace of mind with adjustable-rate mortgages (ARMs) or commercial loans that reset every few years.

Lower Payments = Better Cash Flow

With a 30-year mortgage, your payment is spread over a longer term, meaning lower monthly obligations. This translates to more profit each month.

Compared to a 15-year mortgage or a commercial loan, the lower monthly cost allows you to:

- Reinvest in repairs or upgrades

- Save for the next down payment

- Meet lender DSCR (Debt Service Coverage Ratio) more easily

It’s a great strategy for growing your portfolio without stretching yourself too thin.

Let Inflation Pay Your Mortgage

Here’s where the real magic happens: inflation makes your mortgage cheaper over time. Your $1,896 payment today will feel much smaller in 10 or 20 years—especially as rents increase.

Let’s say you lock in that mortgage in 2024. By 2044, inflation could nearly double market rents, while your mortgage stays the same. You win on both ends: your debt erodes, and your cash flow increases.

This is why smart investors love fixed-rate debt. You’re letting time and inflation do the heavy lifting.

Easier to Qualify Than Commercial or Apartment Loans

Loans on 1-4 unit properties are usually underwritten like personal loans, making them easier to qualify for than apartments or commercial loans.

Here’s how they compare:

| Feature | 30-Year Fixed (1-4 Units) | Apartment/Commercial Loan (5+ Units) |

| Loan Term | 30 years fixed | 5-20 years (often balloon) |

| Interest Rate | 6-7% (2024 average) | 7-9%+ |

| Down Payment | 15-25% | 25-35%+ |

| Underwriting | Personal income + rent | Strict DSCR (1.25x+) |

| Prepayment Penalty | Rare | Common (3-5 years) |

Smaller down payments, no balloons, and simpler underwriting make the 30-year fixed a clear winner for beginners and experienced investors alike.

Built-In Flexibility to Refinance or Reinvest

Another benefit? You can refinance or cash-out later.

Let’s say you buy a duplex at 6.5% interest. A few years later, rates fall to 4.5%. You can refinance, lower your payments by 20%, or pull out equity to fund your next deal.

This optionality gives you room to grow—without needing to sell.

Small Multifamily Sweet Spot

Many investors chase 5+ unit apartment buildings thinking bigger is always better. But the financing terms often kill the deal:

- Shorter amortizations

- Adjustable rates

- High DSCR requirements

- Balloon payments

Sticking with 1-4 unit properties keeps you in the sweet spot. The 30-year fixed mortgage gives you long-term control, better cash flow, and simpler execution.

It’s ideal for:

- House hackers (owner-occupants of 2-4 units)

- Long-term rental investors

- Portfolio builders seeking scalable, predictable debt

What About the Drawbacks?

Yes, there are a few:

1. More Interest Paid Over Time

You’ll pay more total interest vs. a 15-year loan. But you can mitigate this by making occasional extra payments toward principal.

2. Slower Equity Build-Up

Early payments go mostly to interest. That’s okay—you’re playing the long game. Appreciation and cash flow are your main wealth engines.

3. Not for Flipping

The 30-year loan is designed for buy-and-hold strategies, not quick flips. If that’s your game, look elsewhere.

Buffett Was Right

Warren Buffett didn’t casually call the 30-year fixed the best investment tool. He recognized its power:

- Fixed payments that support consistent cash flow

- Debt that shrinks over time thanks to inflation

- Terms that favor small investors more than commercial borrowers

If you’re serious about building wealth through real estate, the 30-year mortgage isn’t just an option—it’s your secret weapon.

Your Next Steps

- Talk to a lender who specializes in investment property loans.

- Run your numbers. Look at cash flow with a 30-year vs. 15-year or an apartment or commercial loan.

- Start with one deal. Learn the process, then scale wisely.

The best time to invest was yesterday. The next best time? Today—with the right loan structure.

“If I were an investor today, I would load up on 30-year mortgages.” — Warren Buffett