When you buy something through one of the links on our site, we may earn an affiliate commission.

Want rental income without tenant drama or emergency toilet repairs at midnight? You’re not alone.

Many aspiring real estate investors love the idea of passive income—but hate the idea of being a landlord. The good news? You can still invest in rental properties without managing them yourself. With the help of a professional property manager, you can reap the benefits of real estate ownership without the headaches.

This guide will show you how.

Why Bother With Rentals If You’re Hands-Off?

Real estate has long been one of the most dependable paths to building wealth. Unlike stocks, it’s a tangible asset you can leverage, improve, and collect income from. But let’s be honest—being a landlord isn’t for everyone. Late-night maintenance calls, screening tenants, chasing rent payments, and navigating local housing laws can turn what should be a passive investment into a stressful second job.

That’s where hands-off investing comes in. By hiring a professional property manager, you offload the day-to-day responsibilities while keeping the long-term financial upside. You become the investor, not the operator—freeing up your time while still participating in one of the most powerful wealth-building tools available.

Key Benefits of Hands-Off Investing

1. Passive Income

Rental income keeps flowing—even when you’re on vacation or focused on your primary job. A well-managed property can provide consistent monthly cash flow with minimal effort from you.

2. Property Appreciation

Over time, real estate tends to go up in value. While the market may have its ups and downs, long-term investors often see strong equity growth—especially in growing markets.

3. Tax Advantages

Real estate comes with a buffet of tax benefits. You can deduct mortgage interest, property taxes, repairs, insurance, and management fees. Plus, depreciation allows you to reduce your taxable income on paper—even if your property is turning a healthy profit.

4. Inflation Hedge

Unlike cash savings that lose value over time, rental properties often rise in both value and rental income with inflation. Meanwhile, your mortgage payment stays fixed (if you have a fixed-rate loan), improving your margins each year.

Real Example

Imagine you purchase a rental property for $250,000. It brings in $2,000/month in rent. After accounting for mortgage payments, property management, maintenance, and other expenses, you could still walk away with $10,000–$15,000 in net annual income. That’s a solid return—and you didn’t have to screen a single tenant or fix a leaky faucet.

What Property Managers Actually Do

Think of a property manager as your on-the-ground partner—the one who deals with the headaches so you can enjoy the benefits of owning rental property without getting your hands dirty. Whether it’s coordinating repairs or dealing with tenant complaints, they’re the buffer between you and the day-to-day drama.

A good property management company can make or break your experience as a hands-off investor. Their role is to protect your time, your property, and your income stream.

Services They Handle for You

1. Tenant Screening

They advertise your property, vet applicants with background and credit checks, verify income, and handle the lease paperwork—making sure you get reliable tenants from the start.

2. Rent Collection

They set up systems for on-time, automated rent collection and enforce payment policies so you don’t have to chase down late checks or send awkward reminders.

3. Maintenance & Repairs

From minor fixes like leaky faucets to scheduling larger projects like HVAC repairs or roof work, property managers coordinate everything—often using their network of trusted contractors at preferred rates.

4. Emergency Response

Whether it’s a broken water heater at 2 a.m. or a power outage during a storm, they’re on call 24/7 to handle emergencies so you don’t have to drop everything.

5. Legal & Regulatory Compliance

They stay up to date on landlord-tenant laws, fair housing rules, and local regulations. This includes managing lease agreements, security deposits, eviction processes, and ensuring your property stays in compliance—reducing your legal risk.

What You Still Control

Even with a property manager, you’re still the decision-maker. You choose which properties to buy, which manager to hire, and when to scale your portfolio. You’ll also weigh in on key decisions—like approving major repairs, setting rent increases, or deciding when to sell.

In other words, you’re still in the driver’s seat—but someone else is handling the steering on your behalf.

What It Costs to Go Hands-Off

Yes, hiring a property manager comes at a cost—but it’s an investment in your time, peace of mind, and long-term scalability. Think of it as outsourcing the parts of rental ownership that can be stressful, time-consuming, or even risky when done wrong. For many investors, the trade-off is well worth it.

Rather than juggling tenant issues, maintenance calls, and lease logistics, you’re paying a professional to make the property run smoothly—while you focus on the big picture.

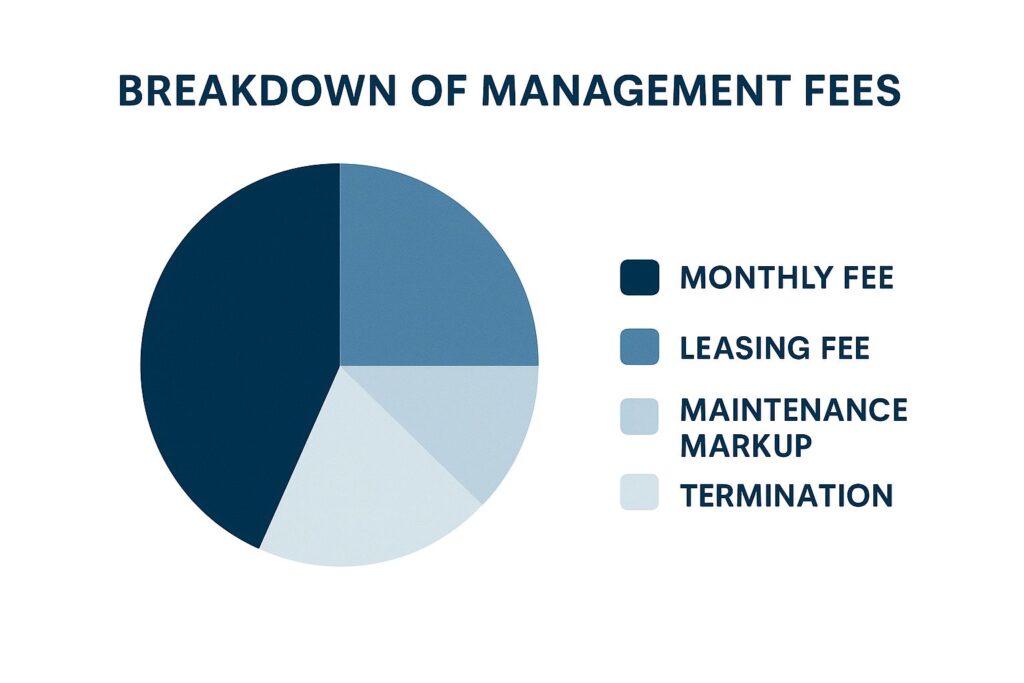

Typical Property Management Fees

Here’s a breakdown of what you can expect to pay:

1. Monthly Management Fee:

8–12% of Collected Rent. This is the standard ongoing fee for handling the day-to-day operations. It covers rent collection, communication with tenants, coordination of basic maintenance, and regular reporting. If your rent is $2,000/month, expect to pay around $160–$240/month for management.

2. Leasing or Tenant Placement Fee:

50–100% of One Month’s Rent. When a new tenant needs to be found, most property managers charge a leasing fee. This includes advertising the unit, conducting showings, screening applicants, and preparing the lease. This fee is typically charged once per new tenant cycle.

3. Maintenance Markup:

10–20% of Repair Costs. If the manager handles repairs using third-party contractors, they may charge a small markup for coordination. For example, if a repair costs $300, you might pay $330–$360 total. This incentivizes the manager to respond quickly and manage repairs efficiently.

4. Early Termination Fee:

1–2 Months’ Rent. If you decide to end the contract early, there may be a penalty. This protects the manager from sudden revenue loss, especially if they’ve recently placed a tenant on your behalf.

Is It Worth It?

For many investors, absolutely. If property management fees take 10% of your rent but save you 90% of the headaches, that’s a win. Plus, experienced managers can reduce costly mistakes, minimize vacancies, and keep your property in better condition—which can actually boost your overall returns in the long run.

Bottom line: You’ll earn slightly less—but do far less.

How to Find a Great Property Manager

Choosing the right property manager can make or break your rental experience. A great manager can turn your investment into a truly passive income stream, while a poor one can cost you time, money, and peace of mind. Since they’ll be acting on your behalf, it’s critical to find someone trustworthy, responsive, and experienced.

Where to Start Your Search

The best property managers are often found through trusted referrals. Ask local real estate agents, fellow investors, or landlords for recommendations. These people know the players in your area and can steer you toward those with a solid reputation. You can also check online reviews on Google, Yelp, or real estate forums like BiggerPockets. While no company has a perfect record, consistent themes in reviews—good or bad—can help you identify who’s worth a closer look.

Another great strategy is to attend local real estate meetups or networking events. You’ll get firsthand feedback from investors who have worked with property managers in your market, giving you a more candid sense of what to expect.

What to Watch Out For

As you begin speaking with potential managers, pay close attention to how they communicate. Poor responsiveness, vague answers, or unclear contracts are early warning signs. Be cautious of anyone who overpromises—claims like “zero vacancies” or “guaranteed rent” often don’t hold up in real-world investing. A reputable manager should be upfront about risks, offer transparency around fees, and be willing to walk you through how they operate.

Questions Worth Asking

Before hiring a property manager, schedule a call or in-person meeting to interview them. Ask how they handle emergency repairs, and whether they have a 24/7 response system in place. Their tenant screening process is also key—look for a detailed approach that includes credit checks, background screening, and income verification.

You’ll also want to request a sample owner report. This will show you how clearly and consistently they communicate your property’s performance. Ask about their average vacancy rate, and whether they have experience managing properties like yours—single-family homes, multifamily units, or short-term rentals, for example. Their familiarity with your local market can make a big difference in tenant retention and rental pricing.

Staying Vigilant (Even When You’re Hands-Off)

Even with a property manager, things can still go sideways. Bad tenants can slip through weak screening processes. Some managers may mark up repair costs or push costly vendors. Others might bury surprise fees in loosely written contracts.

That’s why it’s important to stay engaged at a high level. Review your monthly financial reports, even if everything seems to be running smoothly. If your rental is nearby, visit it occasionally to ensure it’s being maintained. And consider starting with one property before handing over an entire portfolio. Most importantly, make sure your management agreement is clear and detailed—every responsibility, fee, and exit clause should be spelled out in writing.

Who This Strategy Works Best For

Hiring a property manager isn’t the right move for every investor—but for many, it’s a smart trade-off between control and convenience. It allows you to benefit from rental property income without getting bogged down by the daily demands of being a landlord.

This approach is particularly well-suited to busy professionals who don’t have the time or interest to manage tenants, coordinate repairs, or chase down late rent payments. If you’re already juggling a full-time job, a business, or a family, outsourcing the operational side of your rentals can free you to focus on higher-level financial goals.

It also works well for out-of-state investors who want to build a portfolio in growing markets far from home. When you can’t easily visit your properties in person, a trusted property manager becomes your eyes, ears, and hands on-site—handling everything from move-ins to maintenance without requiring your physical presence.

Even if you’re local, this strategy is appealing to those who love the idea of generating income from real estate but want nothing to do with the day-to-day headaches. If you view real estate as a long-term investment vehicle rather than a hands-on side hustle, working with a property manager aligns perfectly with that philosophy.

When It’s Not the Right Fit

That said, hiring a property manager isn’t for everyone. If you’re trying to squeeze every last dollar of profit from your rentals, the fees involved may feel like too much of a sacrifice. Hands-on landlords often save money by doing repairs themselves, finding tenants without paying a leasing fee, and keeping tight control over expenses.

This strategy can also be frustrating for highly detail-oriented or control-driven investors. If you have a hard time letting go of tasks or trusting others to make decisions on your behalf, you may struggle with the necessary delegation property management requires.

Finally, this approach doesn’t usually work well for flippers or short-term investors. If your strategy relies on quick turnarounds or maximizing value in a short time, the added expense and slower communication loop with a manager may hinder your results.

Ideal For:

- Busy professionals

- Out-of-state investors

- People who want real estate income without doing the work

Not Ideal For:

- Investors looking to squeeze out every dollar

- Control-oriented personalities

- Flippers or short-term investors

What to Do Next

If you’re ready to start building wealth through rental real estate—without becoming a full-time landlord—here’s your plan:

- Pick a promising rental market (job growth, low vacancy rates).

- Buy your first property with solid rental potential.

- Interview at least three property managers.

- Start small. One unit is all you need to get going.

Final Thoughts

You don’t need to be on call for every plumbing issue or personally track down late rent payments to succeed in real estate. The traditional image of a landlord—fixing toilets at midnight and handling tenant drama—isn’t the only way to earn rental income.

By outsourcing the day-to-day operations to a skilled property manager, you can enjoy the financial benefits of real estate without the operational burden. You’ll still maintain control over the big-picture decisions while freeing up your time, lowering your stress, and positioning yourself to grow a scalable, long-term investment portfolio.

Hands-off investing isn’t just for the wealthy—it’s a practical path for anyone who wants the rewards of rental property ownership without turning it into a second job.

So here’s the question…

Would you consider investing in rental property if you never had to deal with tenants or maintenance calls?

Share your thoughts in the comments—I’d love to hear your take.