When you buy something through one of the links on our site, we may earn an affiliate commission.

President Trump’s sweeping tariffs on imported goods—covering everything from steel and aluminum to lumber and appliances—have made headlines for their impact on trade and inflation. But for small landlords with one to four rental properties, these policies come with hidden costs that could quietly chip away at profits.

While much of the national conversation focuses on homebuilders and large-scale developers, small real estate investors face a different kind of pressure. Rising material costs strain budgets, tenant turnover becomes more expensive, and even property taxes may climb.

And here’s the kicker: tariff rates are constantly changing. One month it’s 14.5% on Canadian lumber, the next it might jump to 25%—or fall back again. But even as the exact numbers fluctuate, the issues for landlords remain the same: higher costs, tighter margins, and the need to stay nimble.

1. Rising Costs for Repairs and Renovations

Tariffs on critical building materials—like steel, lumber, and imported appliances—make even routine repairs more expensive. A kitchen refresh or roof repair might now cost 10–25% more than just a year ago.

And because tariffs shift with little warning, contractors may hesitate to lock in pricing, causing project delays and extended vacancies.

Smart moves:

- Buy materials in bulk when prices dip.

- Use cost-effective alternatives (like luxury vinyl plank instead of hardwood).

- Pad your renovation budgets to account for price swings.

2. Higher Turnover Expenses and Tougher Tenant Talks

Tariff-driven inflation can squeeze your renters’ wallets, making them less likely to absorb rent hikes—even as your costs go up. Meanwhile, turnover expenses like paint, cleaning, and ads keep rising with material and labor prices.

💡Pro Tip: Offer early lease renewals to solid tenants.

3. Insurance Premiums and Property Tax Pressures

Even if you don’t see the tariffs directly on a receipt, they can creep into other expenses. Rebuilding costs rise, so insurers raise premiums. Housing supply tightens, and assessors may bump your property valuation—leading to higher property taxes.

Stay ahead by:

- Reviewing your insurance for construction-cost inflation.

- Contesting any inflated property assessments with comparable data.

4. Financing Future Investments May Get Tougher

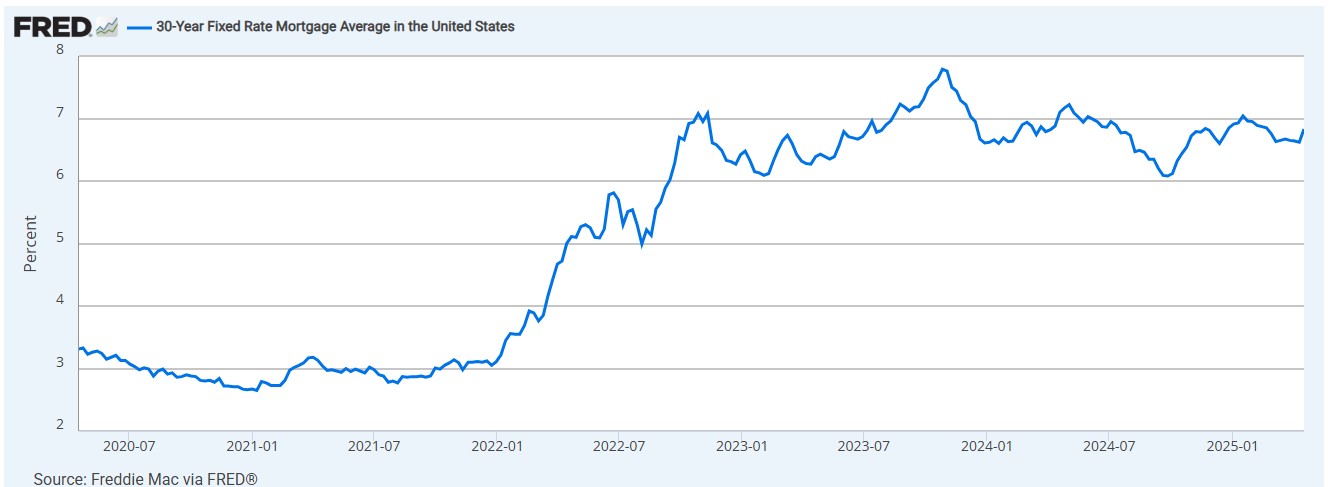

If tariffs keep inflation high, the Fed may hold off on interest rate cuts—keeping borrowing expensive. That impacts your ability to refinance or buy new properties affordably. Banks may also tighten lending standards in volatile markets.

Your next steps:

- Refinance or secure a HELOC before rates rise again.

- Invest in markets where rental growth still outpaces costs—Midwest cities are a good bet.

5. The Silver Lining: Less Competition From New Construction

Tariffs might slow new construction by increasing costs for developers. Fewer new rentals can mean tighter supply and higher demand for existing units—good news for small landlords.

Strategic upside:

- In hot markets like Cincinnati or Cleveland, a smart rent increase might be more palatable amid limited housing supply.

- Focus on tenant satisfaction to encourage longer stays and reduce vacancy.

Final Thoughts: Tariff Rates May Change—But the Risks Remain

Tariff rates might go up, down, or disappear entirely with political shifts. But the underlying effects—rising costs, financing challenges, and pricing uncertainty—are here to stay.

The good news? You don’t need to predict the next tariff to protect your portfolio.

- Audit your expenses.

- Lock in key purchases early.

- Prioritize long-lasting upgrades.

- Double down on tenant retention.

You can’t control trade policy—but you can control how you respond. With a flexible, informed strategy, you can weather the shifts and still come out ahead.