When you buy something through one of the links on our site, we may earn an affiliate commission.

Want to build a rental portfolio but struggling to find an agent who gets what investors need? You’re not alone.

The best investor-friendly real estate agents often fly under the radar. They’re not plastering their faces on billboards—they’re busy helping clients close cash-flowing deals. This guide will show you exactly where to find them, what to ask, and how to stand out as a serious investor.

What Is an Investor-Friendly Agent?

Not all real estate agents are created equal—especially when it comes to working with investors. While many focus on primary homebuyers, an investor-friendly agent understands that your priorities are different.

They know you’re not looking for a white picket fence or a “dream kitchen.” You want:

- Strong cash-on-cash returns

- Off-market deals or value-add opportunities

- Creative financing options like DSCR loans or hard money

- Fast, tactical negotiations

Most importantly, they understand that your time is money—and they won’t waste either one.

Best Places to Find Investor-Friendly Agents

1. Investor Communities

Start where investors already gather.

Wholesalers & Flippers: These professionals often work with agents who specialize in distressed or high-ROI properties.

BiggerPockets: Use the Agent Finder tool to connect with professionals who self-identify as investor-friendly.

Local REIA Meetings: These events are gold mines for referrals from seasoned investors who’ve already vetted agents.

💡Pro Tip: Ask local investors directly who they trust—it’s faster than trial and error.

2. Online Searches (Done Right)

Not all agents with websites are investor-savvy—but some keywords are solid green flags.

Search Google for:

“Investment property agent [your city]”

“Multifamily specialist [your market]”

On Zillow, Realtor.com, or Homes.com, look for agent bios that mention:

- “Cash flow analysis”

- “Multifamily”

- “Off-market deals”

- “BRRRR strategy”

You can also reverse-engineer agent names by browsing the MLS. If you keep seeing someone list 4-plexes, duplexes, or rehab projects—they’re likely working with investors already.

3. Social Media & Content Platforms

YouTube: Some agents break down real deals and share market insights. This content speaks volumes about how they think—and how they work.

LinkedIn: Look for agents posting about cap rates, cash flow, or BRRRR deals. If they’re part of investing conversations, they’re in tune with your goals.

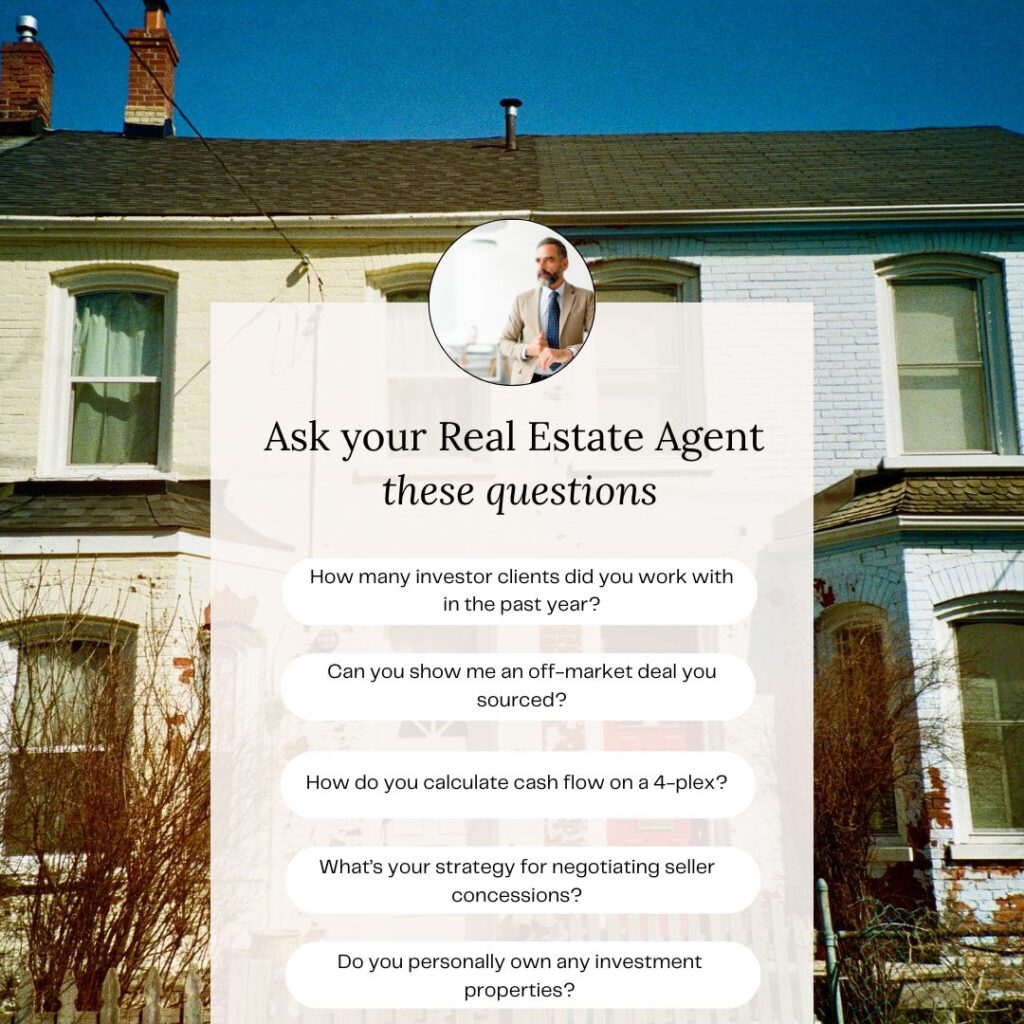

Five Questions to Vet an Agent Like a Pro

Vetting an agent properly can save you months of frustration. Here are five questions to ask:

- How many investor clients did you work with in the past year? You want someone who’s worked with at least 10–12, not just one or two.

- Can you show me an off-market deal you sourced? If they only send you MLS listings, they may not be well-connected.

- How do you calculate cash flow on a 4-plex? A solid answer includes vacancy rates, maintenance reserves, and local expenses—not just “the rent covers the mortgage.”

- What’s your strategy for negotiating seller concessions? Look for tactics like repair credits or interest rate buydowns.

- Do you personally own any investment properties? Agents who invest themselves often bring sharper deal instincts, better connections, and firsthand knowledge of what makes or breaks a rental. They’ll be more likely to catch red flags and think like you do.

How to Get an Investor-Friendly Agent to Take You Seriously

Top agents are busy. They prioritize clients who are decisive, financially prepared, and clear about their goals. Even if you’re just starting out, you can stand out from the crowd by taking a few key steps:

Show You’re Financially Ready

You don’t need millions in the bank to get noticed—but you do need to show you’re serious.

- A simple proof of funds letter (even showing $50K+ in savings or investment capital) signals that you’re ready to write offers.

- Better yet, provide a mortgage pre-approval or a connection to a lender who’s already reviewed your file. This helps agents avoid wasting time on tire-kickers.

Share Your Long-Term Vision

Let agents know this isn’t a one-and-done deal. Say something like:

“My goal is to buy 2–3 rental properties per year over the next five years.”

This tells them you’re thinking like an investor—not just buying a house, but building a portfolio. Agents who work with investors value repeat clients.

Move Quickly and Decisively

In competitive markets, agents need buyers who can act fast. If you’re still “thinking about it,” they’ll focus on others who are ready to move.

- Respond to listings and questions promptly

- Be prepared to make offers within 24–48 hours if the numbers make sense

- Ask for deal analysis upfront so you can make informed decisions quickly

Speak the Investor Language

Use terms like “cash-on-cash,” “value-add,” or “BRRRR” in your conversations. This signals you’ve done your homework—and agents will treat you as someone who’s ready to play at a higher level.

💡Pro Tip: Some agents offer commission rebates to investors—usually 0.5% to 1%. It never hurts to ask.

The First Deal Starts With the Right Agent

You don’t need to master every aspect of investing to buy your first rental property. But you do need someone who knows what they’re doing—and who understands what makes a deal for an investor, not a homeowner.

An investor-friendly agent can:

- Spot red flags in deals before you buy

- Open doors to off-market and distressed properties

- Connect you with investor-focused lenders, contractors, and property managers

They speak your language, protect your capital, and help you scale smarter.

Final Thoughts

Finding an investor-friendly agent isn’t just about saving time—it’s about saving money, avoiding bad deals, and accelerating your journey toward financial independence.

So don’t just Google “best agent near me.” Go where investors go. Ask better questions. Look for patterns. And when you find that agent?

Make it clear you’re not just buying a house.

You’re building a portfolio.